Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be their bank. And in this time of expanded use of online banking, the problem is only growing worse. In fact, customers lost $3.3 billion to phishing, which is the most commonly reported cyber scam, and other fraud in 2020. It’s time to put scammers in their place.

At Minnwest Bank, we’re committed to helping you spot them as an extra layer of protection for your account. We’ve joined with the American Bankers Association and banks across the country in a nationwide effort to fight phishing—one scam at a time. We want every customer to become a pro at spotting a phishing scam—and stop bank impostors in their tracks.

Let's Talk "Phishing"

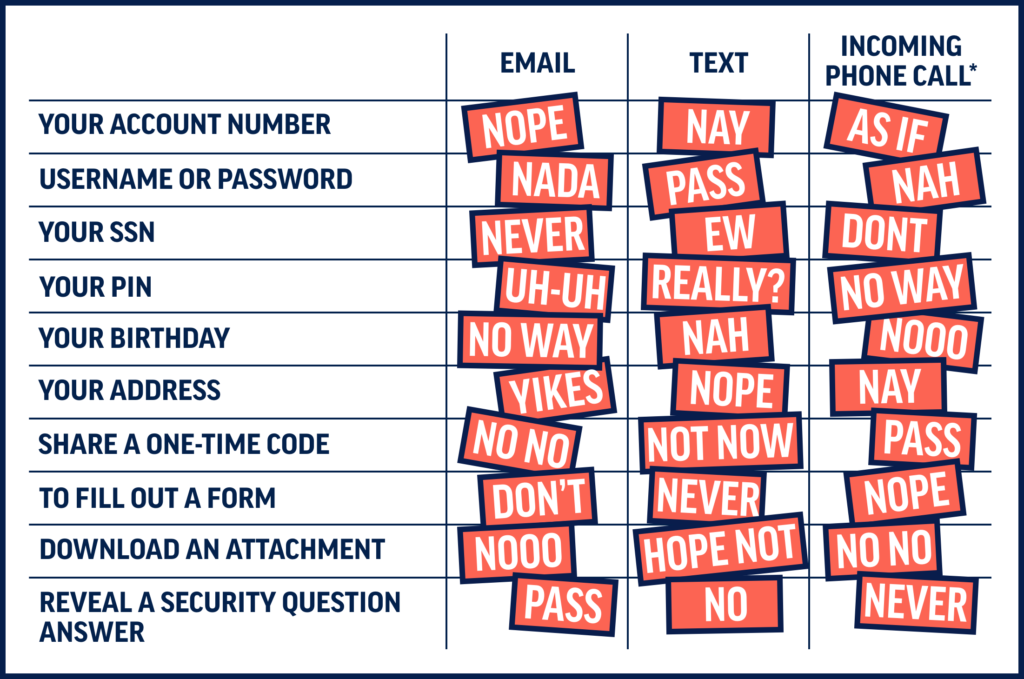

Phishing is a type of online scam where criminals make fraudulent emails, phone calls, and texts that appear to come from a legitimate bank. Every year, people lose hundreds, even thousands of dollars to these scams. The communication is designed to trick you into entering confidential information (like account numbers, passwords, PINs, or birthdays) into a fake website by clicking on a link, or to tell it to someone imitating your bank on the phone.

These top 3 phishing scams are full of red flags:

- Text Message: If you receive a text message from someone claiming to be your bank asking you to sign in, or offer up your personal information, it’s a scam.

- Email: Watch out for emails that ask you to click a suspicious link or provide personal information. The sender may claim to be someone from you bank, but it’s a scam.

- Phone Call: Would your bank ever call you to verify your account number? No! Banks never ask that. If you’re ever in doubt that the caller is legitimate, just hang up and call the bank directly at a number you trust.

If you receive an email, text, or phone call for any of the below information, it’s a definite red flag. It’s better to be safe than sorry. End the call, delete the text, and trash the email, because banks never ask that!

You've probably seen some of these scams before. But that doesn't stop a scammer from trying. Remember these tips so you can spot a scammer before they get to you.

- Be wary of suspicious links. Banks will never send you an email or text that asks you to click on a suspicious link.

- Beware of scare tactics. Scam email, texts and calls may pressure, or even threaten you, to respond.

- Protect your confidential information. Your bank will never ask you to provide confidential information (your account number, SSN, name, address, password, etc.) in emails or text messages. They will only ask for confidential information to verify your identity when you call their toll-free Customer Service numbers.

- Call the number on your card. If you think an email, text or phone call might be a scam, just play it safe and hang up, and call the number on the back of your card.

- Watch for misspelled words. Fraudulent texts and emails often have typos. Real banks use spell check.

What to do if you receive a scam email, call or text:

If you suspect that an email or text you receive is a phishing attempt:

- Take a deep breath. In most cases, it’s perfectly safe to open a scam email or text. Modern mail apps, like Gmail, detect and block any code or malware from running when you open an email. The key is not to click links, or download any attachments.

- Do not download any attachments in the message. Attachments may contain malware such as viruses, worms or spyware.

- Do not click links that appear in the message. Links in phishing messages direct you to fraudulent websites.

- Do not reply to the sender. Ignore any requests from the sender and do not call any phone numbers provided in the message.

- Report it. Help fight scammers by reporting them. Forward suspected phishing emails to the Anti-Phishing Working Group at reportphishing@apwg.org. If you got a phishing text message, forward it to SPAM (7726). Then, report the phishing attack to the FTC at ftc.gov/complaint

If you receive a phone call that seems to be a phishing attempt:

- Hang up or end the call. Be aware that area codes can be misleading. If your Caller ID displays a local area code, this doesn’t always guarantee that the caller is local.

- Do not respond to the caller’s requests. Financial institutions and legitimate companies will never call you to request your personal information. Never give personal information to the incoming caller.

- If you feel you’ve been the victim of a scam, did provide personal or financial information, contact your bank immediately at their publicly listed customer service number. Often, this is found on the back of your bank card. Be sure to include any relevant details, such as whether the suspicious caller attempted to impersonate your bank and whether any personal or financial information was provided to the suspicious caller.